What is KYC in cryptocurrency?

What is KYC in cryptocurrency? I'm by no means an expert, but I thought I'd find out what this means for myself and now that I've done the research, I think I'll share it with you. So, what is KYC in crypto?

I've been learning about cryptocurrency for a while now. Enough that I'm going to share a few things here and there as I learn. Blogging about it will hopefully help me understand things better.

First, KYC is an abbreviation and it stands for Know Your Customer. It's often used in Marketing, Sales, and other industries.

So what is KYC when it comes to cryptocurrency?

KYC stands for know your customer. KYC in cryptocurrency is similar, to KYC in banking and finance, and investing. When you deal with KYC, it means the institution knows everything about you and monitors your account, transactions, and other activity.

One of the things that makes many cryptocurrencies attractive to the users/buyers/traders is their ability to be traded anonymously. I get it that not all cryptocurrencies are anonymous and that in some cases even if you try, it can be nearly impossible to maintain 100% anonymity.

But you have to consider this, as more and more authorities get involved with crypto, the more regulations that come into place. When you use a mainstream cryptocurrency exchange, like Coinbase, or Robinhood, then you have to reveal your personal information.

This information is required for you to participate in their services, and they need the information for the purpose of implementing KYC protocols, processes, and compliance.

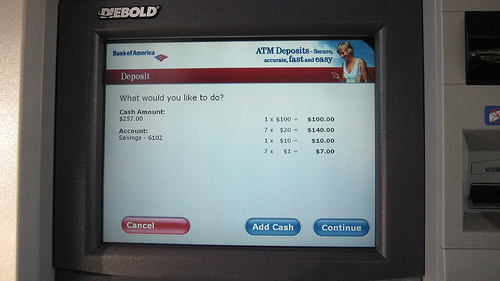

Once you sign up for an exchange, like Coinbase, they now know who you are and they know their customer, they KYC. KYC is a system and collection of processes and protocols that verify the identity of a person transacting business. Generally, this is done in response or in compliance with self-imposed policies, industry regulations, and/or government regulations.

KYC in the investing world

KYC is used in the investing world which also affects cryptocurrencies now and will more in the future. Investopedia says this about KYC:

What Is Know Your Client (KYC)?

The Know Your Client or Know Your Customer is a standard in the investment industry that ensures investment advisors know detailed information about their clients' risk tolerance, investment knowledge, and financial position. KYC protects both clients and investment advisors. Clients are protected by having their investment advisor know what investments best suit their personal situations. Investment advisors are protected by knowing what they can and cannot include in their client's portfolio. KYC compliance typically involves requirements and policies such as risk management, customer acceptance policies, and transaction monitoring.

- Investopedia

But your bank, doctor, insurance, and investors all use KYC

This isn't too bad, right? I mean if you've always and only dealt with Fiat money for your entire life until now, you've always given the bank your information, so this is similar right? The bank uses KYC almost anytime you deal with them. Your doctor does too, your insurance agent does too.

Yes, this is exactly like your bank.

It's okay to share information with them until it's not. It's okay for them to know who you are until the authorities request access to your bank account because they want to investigate it and your bank simply gives them all your information.

What is KYC you ask? That's what KYC means.

It means they literally know you and verify your identity when you transact with them. In crypto, you try to avoid interactions where you are exposing your identity. - Here's a great article that helped me understand more about kyc.

Think of real-life and how you can meet with someone in private and exchange cash for goods or services. Imagine they give you the cash, and you give them the goods; nothing more, nothing less. You don't ask for ID, name, date of birth, or anything. They also don't know who you are. You complete the transaction and remain [mostly] anonymous.

That's more or less how you want to do transactions in crypto, anonymously. If I understand correctly, when you're dealing with big amounts or long-term investments, you want to avoid KYC institutions as much as possible. I guess part of avoiding KYC is that you most likely will need cold storage or a cold wallet. I might tackle that subject next.

So that's really it for now. Being that this is my first post about cryptocurrency, I'll leave it at that short and sweet.